Christians (and it’s good advice for everyone else) are called to be skeptical—several places in the Bible it states check things out for yourself and don’t believe something just because it came from an “authoritative” source; many of those sources turn out to be false. Do your homework, or as Jesus said “Take heed that no one deceive you”.

Of course, much deception comes from politics; many people accept whatever “facts” become thrown out, failing to search and see if those things be true. As Christians, you must not take such a position. Please do your homework.

We’ll consider one such example here. How often have you heard politicians speak of the surplus in the late 1990’s? It’s become folklore, but only one problem with it—it’s totally false (well, not exactly, it’s really a “truth-lie”).

In politics and elsewhere, an interesting phenomenon involves (as John Loeffler calls it) the “truth-lie”—a statement which may (barely) be technically true, but could be designed to deceive you. The myth of the late 1990’s surplus provides a perfect example of the truth-lie. It contains enough truth so no one can be accused of lying, but it has been crafted to deceive you into believing something which isn’t.

As it turns out, during the years of the promoted “surplus”, the country borrowed more money and went further into debt. How can that happen, you may ask. That’s the paradox of the truth-lie—in this example, the politicians promoted a surplus, but the full truth was anything but a surplus existed.

Stay with us during this analysis, it’s vital for you to understand how a truth-lie can be used to deceive you, and remember you’re called to be a skeptic to prevent you from being deceived.

This article responds to comments made on an article concerning the increasing national debt. If you read the comments you’ll notice someone denied the accuracy of the data, and proclaimed instead of deficits the federal government actually had surpluses. After all the discussion, he still denied the data, and prompted this detailed analysis to prove the myth of the surplus — it’s a truth-lie.

**This analysis contains many links and footnotes, so you might want to view the PDF version of “Myth of the Surplus” for easier reading and viewing of all the official government reports.**

Background

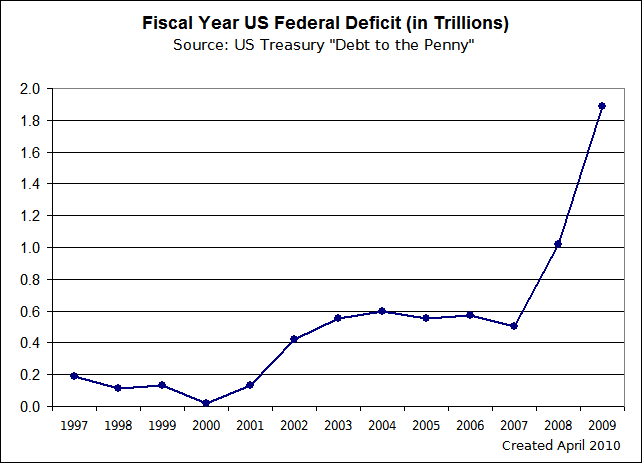

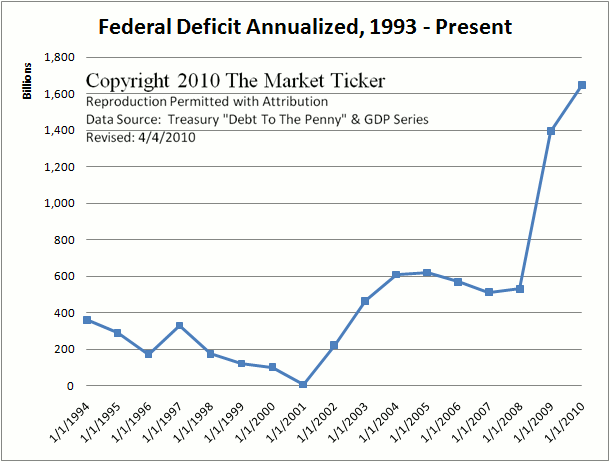

That simple graph from The Market Ticker (http://market-ticker.denninger.net/) caused much confusion during discussion of the increasing national debt, and provides a perfect example of a truth-lie, and why the truth-lie causes so much damage and confusion. Usually, if you dig deep enough, the truth-lie can be exposed for what it is, and this one is no exception.

(September 2000) The estimated surplus of at least $230 billion [FY 2000] follows a surplus of $124 billion in FY 1999 and $69 billion in FY 1998.

http://clinton4.nara.gov/WH/new/html/Tue_Oct_3_113400_2000.html

The error raises such an important issue we’ll take some time to delve into it fully, as not only the myth of the surplus continues to be told, but it’s a good example of how groups manufacture a truth-lie. Stay with us, it’s vital you understand not only the myth, but how a truth-lie comes to life.

Truth-Lie Defined

How can something be truth and lie at the same time? If you involve yourself in politics at all, you’re quite familiar with it, even if you don’t know the name. It’s the art of technically telling the truth, but structuring it in a way which leaves people with a deliberately misleading impression.

Truth, whole truth, and nothing but the truth

Many people believe upon swearing in court before testimony “the truth, the whole truth, and nothing but the truth” repeatedly states the same principle. Not so, the statement has been carefully crafted; those parts do not equate.

- Truth—no lying.

- The Whole Truth—Don’t omit or leave anything out.

- Nothing but the Truth—No opinions or conclusions, let facts speak for themselves.

If you tell the truth, but ignore the other two parts of the oath, it’s quite possible to be technically factual, but deliberately mislead people into thinking something else. Of course, if that’s your goal (as often occurs in political discussions), the truth-lie becomes a most favored and revered strategy.

Definition

truth-lie (n) — A statement which might be technically true, but could create an impression of something else which might not be true. The political equivalent to the magician’s slight of hand, the truth-lie may be specially crafted for the specific purpose of creating a false impression.

For example, you’ll frequently hear during spending fights “the military is the biggest non-discretionary part of federal spending”. Technically true, but note the weasel words “non-discretionary”. Many people don’t know what that is, so they hear “the military is the biggest part of federal spending”, which isn’t true, although that false statement is often repeated.

Thus, a truth-lie is born. Quite popular in politics.

What is the Deficit?

We’ve got to define two terms: debt & deficit. Frequently interchanged, they’re not the same thing, although similar and related to each other.

- Debt—total amount the federal government owes, similar to the balance on a credit card.

- Deficit—the yearly amount the government spends above what it takes in, like spending on a credit card after you’ve spent your entire paycheck.

If you engage in deficit spending, the debt rises by the amount of deficit spending. It’s that simple.

Myth of the Surplus

OK, so now we’re armed with how a truth-lie springs to life, and what the debt and deficit are. Let’s dig into some geeky financial data and see how this specific truth-lie exists. Don’t worry, it won’t really be that bad. Honest.

Did the surplus during those years ever exist? And if not, how did the CBO make it seem like there was? Here’s the relevant part (page 1) from the CBO report cited:

| Year | Public Debt |

|---|---|

| 1997 | 3.772 |

| 1998 | 3.721 |

| 1999 | 3.632 |

| 2000 | 3.410 |

| 2001 | 3.320 |

| 2007 | 5.035 |

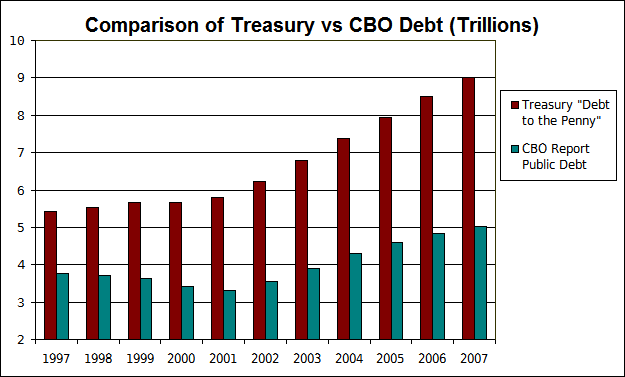

Lo and behold, notice the debt went down a few years; that’s how the myth of the surplus came to be, and is the truth part of the truth-lie. But that’s not the whole truth; the CBO exists as a political entity (while supposedly non-partisan). Recalling back to 2007, nobody claimed the US debt was only $5 Trillion, so the CBO report doesn’t pass the sniff-test; the strange debt level should be a clue somebody’s playing with incomplete information.

Where else can information on the United States national debt be found? Consider the official keepers of the national debt, the US Treasury department where you can obtain the official United States debt to the Penny.

From the official keepers of the United States Federal Government National Debt, here’s what they reveal on the total national debt of the United States (Note: Federal fiscal years run Oct-Sep, so the end of September represents the end of the year. This causes confusion for those thinking the end of the year arrives on December 31st).

| Year | National Debt |

|---|---|

| 9/30/1997 | 5.413 T |

| 9/30/1998 | 5.526 T |

| 9/30/1999 | 5.656 T |

| 9/29/2000 | 5.674 T |

| 9/28/2001 | 5.807 T |

| 9/28/2007 | 9.008 T |

| 9/30/2008 | 10.025 T |

| 9/30/2009 | 11.910 T |

| 9/30/2010 | (est) 13.5 T |

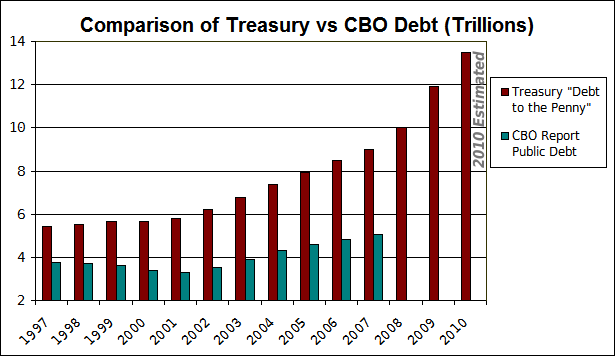

You’ll notice those numbers differ a bit, so let’s look at a graph comparing those numbers; charts of numbers are b-o-r-i-n-g while a picture is worth a thousand words.

Comparing those numbers, immediately a few things jump off the page and scream “notice me!”.

- The debt numbers don’t match! Not even close—the problem isn’t simply a statistical problem or rounding error.

- CBO reports a surplus and a reduction in debt, while the Treasury reports a steady increase in debt. The trends differ.

- CBO reports considerably less debt than the official keepers of the national debt, the US Treasury.

Those items should immediately raise red flags on the data—and you must ask yourself who, what, and why.

- Why do those numbers differ?

- What is missing in the CBO report, relative to the Treasury Department?

- Who benefits from citing the CBO report?

As some people note (and many politicians like to say), the CBO reported a “surplus” for a few years, and the country actually paid down the debt! Yet something’s fishy—the US Treasury reports total debt increased each year, which contradicts the CBO claims of surplus. Who’s right? The CBO, politicians and the commenter? Or the Treasury? Both those numbers can’t be right.

So what’s going on?

How the Debt works

Looking at the detailed treasury data available, you’ll notice it’s divided into two parts—public and Intragovernmental holdings; allow the Treasury Department in their FAQ to describe exactly what those are.

What is the Debt Held by the Public? The Debt Held by the Public is all federal debt held by individuals, corporations, state or local governments, foreign governments, and other entities outside the United States Government less Federal Financing Bank securities.

What are Intragovernmental Holdings? Intragovernmental Holdings are Government Account Series securities held by Government trust funds, revolving funds, and special funds; and Federal Financing Bank securities.

Notice the words “Government trust funds”—does that ring a bell…like Social Security? Ding ding ding! Winner! It’s money the government owes itself, or perhaps phrasing it better would be obligation—it’s an obligation of the Federal government and must be paid, exactly the same as any other debt.

If you would like further detail, Craig Steiner has more information on calculating the debt and explaining how it works.

Surplus Shell Game: Creating a truth-lie

Now you understand the debt/deficit, and how the Treasury accounts for the total debt. Armed with those facts, it should be easy to figure out how the CBO played the surplus shell game.

Simply put, they borrowed from their left pocket (raiding Social Security and other “trust” funds) and put it in their right (the general fund), reporting only the money in the right pocket. Surprise! Instant surplus. Of course, if you’ve studied Social Security, you know no lockbox exists, nothing but IOU’s exists (one of the reasons we’re in big trouble, but entitlement spending is a topic for another time).

Notice the weasel words on the CBO report “Debt held by the Public”, which you’re now quite aware ignores a huge portion of the national debt. Most people have no idea what the different parts of the debt are, and certainly don’t ever look at the official US debt from the Treasury, blindly believing what they’ve been told. That’s why this truth-lie works.

Let’s put all we’ve found in one chart (the truth, the whole truth, and nothing but the truth).

| Treasury Dept | CBO | |||

|---|---|---|---|---|

| Date | Pub Debt | IG Debt | Total | Pub Debt |

| 1997 | 3.79 | 1.62 | 5.41 | 3.77 |

| 1998 | 3.73 | 1.79 | 5.53 | 3.72 |

| 1999 | 3.64 | 2.02 | 5.66 | 3.63 |

| 2000 | 3.41 | 2.27 | 5.67 | 3.41 |

| 2001 | 3.34 | 2.47 | 5.81 | 3.32 |

| 2002 | 3.55 | 2.68 | 6.23 | 3.54 |

The CBO only reports part of the picture—they don’t tell the whole truth! They report public debt, but ignore Intragovernmental Holdings. Notice the similarity of the Treasury and CBO’s Public Debt numbers, but CBO completely ignores Intragovernmental Holdings, which means their debt numbers are incomplete (and quite less than total debt).

But as can be clearly seen, the national debt never went down, thus, by definition, the US government spent more than it received in revenue—in other words deficit spending. The “surplus” mentioned over and over never existed (and the debt was never “paid down”)—US debt increased each year, when you take the complete picture and use all the data.

It’s an attempt to deceive you, and based on how many people believe such a surplus actually existed, it’s been a very effective truth-lie.

Washington’s Twilight Zone

How do they claim a surplus, while the truth is otherwise? It all depends on what “is” is. Seriously. For example, a budget defined as “An estimation of the revenue and expenses over a specified future period of time” can be compared to a report to see how well it matches the definition.

A budget takes total income and total expenses for a period of time (usually a fiscal year) and the difference yields either a surplus or deficit. If you buy a latte for $5 and a Porche for $50,000, with a yearly salary of $40,000, you’ve got a deficit of $10,005. Simple really. But that’s not how Washington works.

They’ll pass on the latte, buy the Porche, and proclaim “we’ve saved $5”, and in their “budget”, ignore the Porche (try that with your accountant and see how far you get). Of course, the Treasury Department—which must deal with total spending—borrows $50,000 and adds it to the national debt.

Presto! Instant surplus. Of course, the promoted “surplus” comes from borrowed money. For example, suppose a family wants to live above their means and each month dips into their home equity line of credit. Presto! More income, and more to buy cars and other items with. Then they ignore the increasing mountain of debt and life is good!

Wait a minute, many people tried that exact strategy and it didn’t work out too well, did it? The resulting mortgage foreclosure rates demonstrate you can’t simply borrow and spend, while thinking it’s a surplus of income. The Federal Government differs not a bit from that example—sooner or later the bill comes due.

That’s the answer to why CBO and Treasury data differ, and how CBO claims (in our mythical example) a savings (“surplus”) of $5, while the Treasury Department actually borrows $50,000. It’s similar to a magician’s slight-of-hand to get you looking in one direction, while ignoring reality. The magician may perform his slight-of-hand directly in front of you, but it’s easy to miss the deception.

Where the money came from

The money comes from Social Security and other trust funds, you know, that “lock box” where your contributions are supposed to go? They spent it. The social security debt and obligation still exist, but they took the social security taxes (stole might be a better word) from one pile (the social security trust fund), put it in another (the general year fund), spent it, and left IOU’s in the social security fund. If you’re upset after you notice they’ve been lying all along, it’s understandable.

Did anyone know and understand this was occurring? Some did, but ask yourself, have you heard much reporting about the following?

(Wall Street Journal) In the late 1990s, the government was running what it—and a largely unquestioning Washington press corps—called budget “surpluses.” But the national debt still increased in every single one of those years because the government was borrowing money to create the “surpluses.”

http://online.wsj.com/article/SB124277530070436823.html

(Mises Institute) The federal government spends Social Security money and other trust funds which constitute obligations to present and future recipients. It consumes them and thereby incurs obligations as binding as those to the owners of savings bonds. Yet, the Treasury treats them as revenue and hails them for generating surpluses. If a private banker were to treat trust fund deposits as income and profit, he would face criminal charges.

http://mises.org/daily/542

The Social Security Administration is legally required to take all its surpluses and buy U.S. Government securities, and the U.S. Government readily sells those securities—which automatically and immediately becomes Intragovernmental holdings. The economy was doing well due to the dot-com bubble and people were earning a lot of money and paying a lot into Social Security.

Since Social Security had more money coming in than it had to pay in benefits to retired persons, all that extra money was immediately used to buy U.S. Government securities. The government was still running deficits, but since there was so much money coming from excess Social Security contributions there was no need to borrow more money directly from the public. As such, the public debt went down while Intragovernmental holdings continued to skyrocket.

http://www.craigsteiner.us/articles/16

Sausage-making and the CBO

Why would the CBO release such information? A clue comes from how they work. If you think they take a proposed bill, carefully examine it and report the financial results you’re quite naive. The trick Congress uses to game the system remains quite simple: CBO scores whatever they’re told.

Really, that’s the key. To understand that little scam, suppose I put forth the following bill:

SB 2345: The Cancer Medical Savings Act of 2010

Whereas, cancer causes such hardship and financial disaster for many Americans, and it creates undue cost for the treatment thereof, be it resolved by this Congress cancer is hearby eliminated, beginning with fiscal year 2012.

What would CBO do? They’ll dutifully score the “savings” for this bill, reporting back to Congressional leaders all the billions in “savings” from our bill. Absurd? Of course.

CBO reports whatever the bill contains—if a bill says cancer disappears in one year, they’ll score it. In other words, they don’t necessarily score the assumptions of the bill, but only what effect those assumptions will have. (Sometimes in the report you might see a warning about assumptions, but that’s about it as everyone focuses on the alleged “savings”, not the warnings).

Then Senators get up on the Senate floor and proclaim “SB 2345 has billions in savings, says the CBO. We need to pass this now!”, all the while knowing it’s a stinking festering pile of poo. Yep, it can be that dishonest.

While they’re supposed to be non-partisan, they certainly are political, and quite easy to game to get whatever results you want.

Truth-Lie

In short, the CBO report doesn’t pass muster (it doesn’t even add up as the appendix proves, a not-so-subtle clue it excludes items), as they didn’t tell the whole truth. It’s a truth-lie. And now you know, as Paul Harvey would say … the rest of the story.

Objections

Various people for their own reasons attempt to justify the CBO data, but those discussions aren’t worth much consideration, as one fact exists they can’t escape—if a surplus existed, why did the government borrow more money during years of alleged “surplus”, increasing the total debt? Nevertheless, let’s consider a few of those objections, and notice how quickly they can be dismissed as incorrect.

The variances between CBO and Treasury are just statistical noise. Not true. Examine the chart and notice the Public Debt numbers for the CBO and the Treasury are quite close, but the CBO doesn’t report the IG debt, thus their reporting of debt equals only about half total US debt. Since they don’t include all the data, the conclusion won’t be accurate either.

| Treasury Dept | CBO | |||

|---|---|---|---|---|

| Date | Pub Debt | IG Debt | Total | Pub Debt |

| 1997 | 3.79 | 1.62 | 5.41 | 3.77 |

| 1998 | 3.73 | 1.79 | 5.53 | 3.72 |

| 1999 | 3.64 | 2.02 | 5.66 | 3.63 |

| 2000 | 3.41 | 2.27 | 5.67 | 3.41 |

| 2001 | 3.34 | 2.47 | 5.81 | 3.32 |

| 2002 | 3.55 | 2.68 | 6.23 | 3.54 |

The IG Debt doesn’t count, and that’s why CBO doesn’t use it. Tell that to all the recipients of Social Security who count on those trust funds. Yes, it really does count as part of the debt, as any reporting of the US debt will include (currently about $13 Trillion and rising).

The total debt includes “off-budget” items CBO doesn’t use. Imagine telling your accountant you took out a home equity loan, used it to buy a new car, so your net worth went up … as long as you ignore the new loan. That’s quite absurd. Obviously to get a complete picture, complete data must be used. No Enron-style rules allowed (if you want a complete picture).

But Factcheck.org says even if you remove Social Security, the surplus still existed. That’s another truth-lie of it’s own. Yes, that may be true (we didn’t fact-check their numbers) but other trust funds exist besides Social Security. To dig into that, the Treasury Department issues Monthly Treasury Statement (MTS) detailing financial transactions, and you can examine the September 2000 report showing Social Security trust funds of $152.3 Billion, while total funds equal $246.5 Billion. That’s about $100 Billion missing from the factcheck.org analysis (maybe we need fact-checkers for factcheck.org. Hat Tip for the FactCheck analysis: Craig Steiner).

Bottom line: CBO doesn’t include all the debt in their report. Period. The Treasury does. Thus it’s no surprise those two methods don’t yield the same result—different inputs, different outputs. Of course, if you want a total picture of how much the country owes, common sense says you’d better use all the data.

Deficit-Deniers

By using a small amount of critical thinking, it’s obvious the CBO numbers don’t include the entire picture, and thus don’t result in a complete picture of the debt/deficit.

In the end, those still clinging to the myth of the surplus (shall we call them deficit-deniers?) simply haven’t done their homework. Yes, it’s tedious and boring, but a through analysis demonstrates the surplus never existed, and your children will have to pay for all the deficit spending … even during “surplus” years.

… the borrower is servant to the lender. (Proverbs 22:7 NKJV)

Permission is granted to freely share the PDF version as long as it’s not modified and not used for commercial use.

Appendix: Detailed Analysis of the CBO Report

Here’s the detail from CBO historical budget data, page 1 in all it’s glory:

| Revenues, Outlays, Deficits, Surpluses and Debt Held by the Public, in Billions | |||||||

|---|---|---|---|---|---|---|---|

| Year | Revenue | Outlay | On Budget | Soc Sec | Postal Serv | Total | Pub Debt |

| 1997 | 1,579.4 | 1,601.3 | -103.2 | 81.3 | * | -21.9 | 3,772.3 |

| 1998 | 1,722.0 | 1,652.7 | -29.9 | 99.4 | -0.2 | 69.3 | 3,721.1 |

| 1999 | 1,827.6 | 1,702.0 | 1.9 | 124.7 | -1.0 | 125.6 | 3,632.4 |

| 2000 | 2,025.5 | 1,789.2 | 86.4 | 151.8 | -2.0 | 236.2 | 3,409.8 |

| 2001 | 1,991.4 | 1,863.2 | -32.4 | 163.0 | -2.3 | 128.2 | 3,319.6 |

First thing to notice, the total debt in the last column isn’t the same as the total national debt recorded by the Treasury department—the guys who actually handle the debt. This alone reveals hidden items in the CBO report, or items excluded in the totals presented. Notice the last column “public debt” — where are the Intragovernmental Holdings? They fail to include it, thus their national debt is wrong, and thus so are their conclusions about the claimed surplus (which never existed).

But that’s not the only problem with the report—it simply doesn’t add up. Notice the “surplus” in 2000 equaled $236.2 Billion. That means the debt went down by $236.2 billion, right? Well, not exactly (remember, this is Washington math). In 1999 the debt was $3,632.4 Billion, and in 2000 after the “surplus” of $236.2 Billion the debt totaled $3,409.8 Billion. Notice anything fishy? Try this math: 3,632.4 - 3,409.8 = 222.6. Hmmm … A “surplus” of $236.2 Billion reduces the deficit not by $236.2 Billion, but $222.6 Billion. Tilt! Where’s the missing $13.6 Billion? The CBO numbers don’t add up. That alone should be a not-so-subtle clue of a strange issue, something you need to dig in to deeper.

Spending Social Security

Let’s analyze the 2000 numbers. Notice the “on-budget” surplus claim of $86.4 Billion, with total surplus of $236.2 Billion. But notice they included Social Security of $151.8 Billion! Wait a minute, those are supposed to be trust funds, and already guaranteed to the recipients of Social Security. In other words, they counted that money twice!

Additionally, as we saw earlier in the MTS (Table 6 Schedule D Investments of Federal Government Accounts in Federal Securities, September 2000 and Other Periods. http://fms.treas.gov/mts/mts0900.pdf page 24-25), Social Security isn’t the only trust fund. According to that report, Social Security in 2000 had $152.3 Billion in funds (CBO reported $151.8 Billion), but that wasn’t the only trust fund.

Looking at pages 24-25 of the September 2000 MTS, notice the grand total of funds—$246.5 Billion dollars, or about $94.2 Billion more than what appears on the CBO report. Thus, the alleged surplus of $236.2 Billion, subtract Social Security of $151.8 Billion (adjust for Postal Service as well), and you arrive at the on-budget number of $86.4 Billion in the CBO report.

But from the MTS, we know that’s not all the trust funds, so we also have to subtract $94.2 Billion (which doesn’t appear in the report) from the $86.4 Billion to arrive at a deficit of $7.8 Billion for the year 2000, all the while politicians (and others) promoted the truth-lie of a $236.2 Billion “surplus”.

Thus, according to the CBO report, and including all available data, we arrive at a 2000 deficit of $7.8 Billion, instead of the claimed “surplus” of $236.2 Billion. So how much did the Treasury actually borrow that year? From the Treasury “Debt to the Penny”, 9/29/1999 the debt equaled $5.656 Trillion, and on 9/29/2000 the debt equaled $5.674 Trillion, and on 9/28/2001 th debt equaled $5.807 Trillion. Those equal deficits of $18 Billion and $133 Billion respectively (and match the chart which the commenter objected to), instead of surpluses.

That’s how the country went further in debt during years of alleged “surplus”. By now you can see by scrutinizing the reports and using all the data from Federal sources the CBO doesn’t include all financial data in their report, thus the result won’t provide a complete picture either.

Notice also in the CBO report, they state openly they spent the Social Security trust fund. That should cure the myth of the Social Security trust fund “lock-box”, but entitlements are a subject for a later time.

CBO Reporting

It’s not just that year, the 1999 surplus was $125.6 Billion, but the reduction in debt was 3,721.1 - 3,632.4 = 88.7, or a difference of $36.9 Billion less in debt reduction than the alleged surplus would indicate.

In short, some people might try to explain why the CBO report doesn’t add up, but simply note the CBO data is internally inconsistent—in other words, it doesn’t add up (quite literally). Billions of dollars escape reporting; what kind of accounting system ignores major portions of debt?

Oh yeah, Washington style, where deficits can be reported as surplus and everyone believes it—with “surpluses” like these, the country will be bankrupt soon as Federal debt continues to rise.

Charts