The runaway inflation beginning around 2020 created much confusion, even among so-called experts who claimed ability to keep it in check, saying things like:

- Inflation won’t happen

- Inflation is occurring, but it’s only a little

- Inflation is bad, but it’s “transitory”

- Inflation will last several years

Only the last comment is honest (and true); the reason being if you don’t know what causes inflation you won’t know why it’s happening and worse, won’t know what to do to prevent it.

Let’s define inflation as it’s the reason many are confused; Webster’s New World College Dictionary, Fourth Edition:

in·fla·tion

- An inflation or being inflated

- a) An increase in the amount of money and credit in relation to the supply of goods and services b) an increase in the general price level, resulting from this, specifically, an excessive or persistent increase, causing a decline in purchasing power.

As of September 2023, the online Webster’s dictionary:

a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services

https://www.merriam-webster.com/dictionary/inflation

Perhaps you’ve heard commentators or politicians speak of inflation being rising prices. If someone claims rising prices are inflation (or causing it) it tells you they either don’t know what they’re talking about, or they’re trying to deceive you.

Rising prices is the result of inflation, not the cause.

Let’s relate money to gold. Suppose someone struck a huge untapped reserve of gold, say five to 10 times what is currently in circulation. What would the price of gold do? It would plummet … because more of it reduces its value.

Money is no different. When excess money is injected into the economy (commonly called “printing money” or “helicopter money”) it reduces the value of it, exactly the same as the gold example.

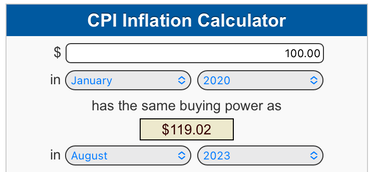

Result? From the government’s CPI calculator, $100 at the beginning of 2020 would require about $120 in August 2023 for the same purchasing power — roughly 20% inflation over the period.

If you didn’t receive a 20% raise, or your savings didn’t earn 20% during that time, you lost money. Poof. Gone.

As the dollars you hold are worth less, prices must increase to compensate for it. Rising prices are the result of inflation, not the cause (and not to be confused with supply and demand).

Second lie you’ve been told — inflation is coming down. 100% false. The rate of increase might be changing, but inflation is permanent (unless a period of deflation occurs, but that is extremely rare).

When the government helicoptered about six trillion dollars during and after the covid pandemic, smart people knew inflation would result (side note: don’t trust people who don’t understand the cause of the problem to be able to fix the problem). It had to as all that excess printing of money devalued the dollars citizen’s were holding.

It is an unchanging law of the universe more of something reduces its value — a law which can not be violated.

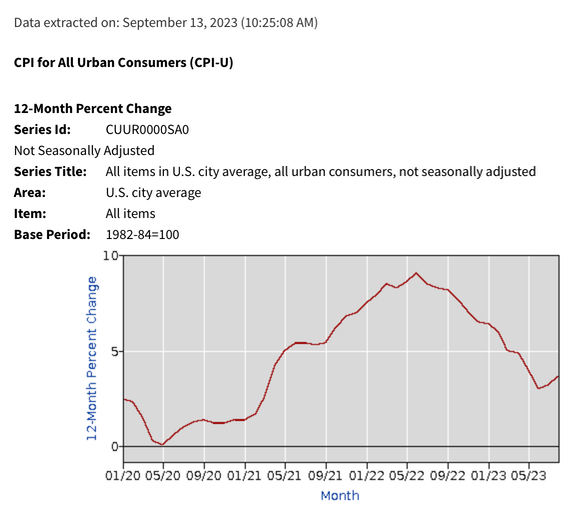

So the rate of increase of inflation might be coming down a little, but you won’t ever see that 20% back. Consider the monthly inflation rates from the government’s CPI data:

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Annual |

| 2020 | 2.5 | 2.3 | 1.5 | 0.3 | 0.1 | 0.6 | 1.0 | 1.3 | 1.4 | 1.2 | 1.2 | 1.4 | 1.2 |

| 2021 | 1.4 | 1.7 | 2.6 | 4.2 | 5.0 | 5.4 | 5.4 | 5.3 | 5.4 | 6.2 | 6.8 | 7.0 | 4.7 |

| 2022 | 7.5 | 7.9 | 8.5 | 8.3 | 8.6 | 9.1 | 8.5 | 8.3 | 8.2 | 7.7 | 7.1 | 6.5 | 8.0 |

| 2023 | 6.4 | 6.0 | 5.0 | 4.9 | 4.0 | 3.0 | 3.2 | 3.7 |

The massive helicopter money injected into the economy around 2020ish created the inflation spike from 2020—2024 — it was impossible to be otherwise. By the time this inflationary cycle which began in 2020 ends late 2024 or 2025, expect the total inflationary loss to be between 1/4 and 1/3 — 25% to 35% total.

Inflation is caused by one thing: creating money, which devalues it. You can call that stimulus, helicopter money, printing money, pandemic relief, or any other name, but it’s all the same: devaluing the dollars you have, which requires more of them to purchase the same goods.

Result of inflating money: prices increase — increasing prices are the result of inflation, not a cause.